maine property tax calculator

Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Historical Maine Tax Policy Information Ballotpedia

The state valuation is a basis for the allocation of money.

. To use our Maine Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Property tax is calculated based on your home value and the property tax rate. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

The state has an average effective property tax rate of 130. Our division is responsible for the determination of the annual equalized full value state valuation for the 484 incorporated municipalities as well as for the unorganized territory. The car sales tax in Maine is 550 of the purchase price of the vehicle.

Maine collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Ad Download Property Records from the Maine Assessors Office. So the tax year 2021 will start from July 01 2020 to June 30 2021.

The ME Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for single joint and head of household filing in MES. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. Calculating your Maine tax year income tax is similar to the steps we outlined on our Federal paycheck calculator.

Property Tax Calculator Maine Property Tax Calculator Maine makes top 5 in states with highest tax burden Mainebizbiz Maine Property Tax Calculator Map. This means that the applicable sales tax rate is the same no matter where you are in Maine. How high is your towns property tax rate.

After a few seconds you will be provided with a full breakdown of the tax you are paying. Figure out your filing status. For example if you purchase a new vehicle in Maine for 40000 then you will.

The typical Maine resident will pay 2597 a year in property taxes. The Maine tax calculator is updated for the 202122 tax year. 109 of home value Tax amount varies by county The median property tax in Maine is 193600 per year for a home worth the median value of 17750000.

Property Tax Calculator Low taxes in Hawaii Property Tax Calculator Property Tax Calculator Maine Property Tax Rates by Town The Master List. Maine Property Tax Calculator Our Maine Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Maine and across the entire United States. If the credit exceeds the amount of your individual income tax due for the tax year the excess amount of credit will be refunded to you.

Maine Property Tax Calculator to calculate the property tax for your home or investment asset. Counties in Maine collect an average of 109 of a propertys assesed fair market value as property tax per year. The annual appreciation is an optional field where you can enter 0 if you do not wish to include it in the ME property tax calculator.

Maine property tax calculator. Your average tax rate is 1198 and your marginal tax rate is 22. Maine has a 55 statewide sales tax rate and does not allow local governments to collect sales taxes.

Maine Income Tax Calculator 2021. Although this is the case keep in mind. Maines maximum marginal income tax rate is the 1st highest in the United States ranking directly.

Municipal Services and the Unorganized Territory. Property taxes are 351 of income in Maine 17th highest in the country. Eligible Maine taxpayers may receive a portion of the property tax or rent paid during the tax year on the Maine individual income tax return whether they owe Maine income tax or not.

This results in roughly 39818 of your earnings being taxed in total although depending on your situation there may be some other smaller taxes added on. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Maine tax year starts from July 01 the year before to June 30 the current year.

The Maine income tax calculator is designed to provide a salary example with salary deductions made in Maine. The average rate in Maine is 109 18th in the country. Filing 13000000 of earnings will result in 766435 of your earnings being taxed as state tax calculation based on 2021 Maine State Tax Tables.

Our Search Covers City County State Property Records. If you make 70000 a year living in the region of Maine USA you will be taxed 11762. Like the Federal Income Tax Maines income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.

The amounts shown are based on percentages derived from the approved FY19 Town of Hampden budget. The Property Tax Division is divided into two units. In short if the vehicle is registered in the state of Maine then the Maine car sales tax of 550 will be applied.

The median income in Maine is 56277. Maine Property Tax Calculator - SmartAsset Maine Property Tax Calculator Overview of Maine Taxes Property tax rates in Maine are well above the US. Our Cumberland County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Maine and across the entire United States.

In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. Overview of Maine Taxes Maine has a progressive income tax system that features rates that range from 580 to. This state sales tax also applies if you purchase the vehicle out of state.

Generally property taxes are higher in the more southern and urban counties in Maine. Find Out Whats Available. There is option to include cost of repairsimprovement that you might have incurred during the holding.

The states average effective property tax rate is 130 while the national average is currently around 107. Each spending category below corresponds to a Town budget category. The Maine tax calculator is designed to provide a simple illlustration of the state income tax due in Maine to view a comprehensive tax illustration which includes federal tax medicare state tax standarditemised deductions and more please use the main 202122 tax reform calculator.

The median property tax in maine is 193600 per year for a home worth the median value of 17750000. The interactive calculator below allows property tax payers to enter the amount of their annual bill to learn how those dollars are allocated to various Town expenses.

Maine Property Tax Rates By Town The Master List

Maine Property Tax Calculator Smartasset

States With Highest And Lowest Sales Tax Rates

Maine Property Tax Calculator Smartasset

Maine Property Tax Rates By Town The Master List

Transfer Tax Calculator 2022 For All 50 States

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Maine Property Tax Calculator Smartasset

Maine Sales Tax Small Business Guide Truic

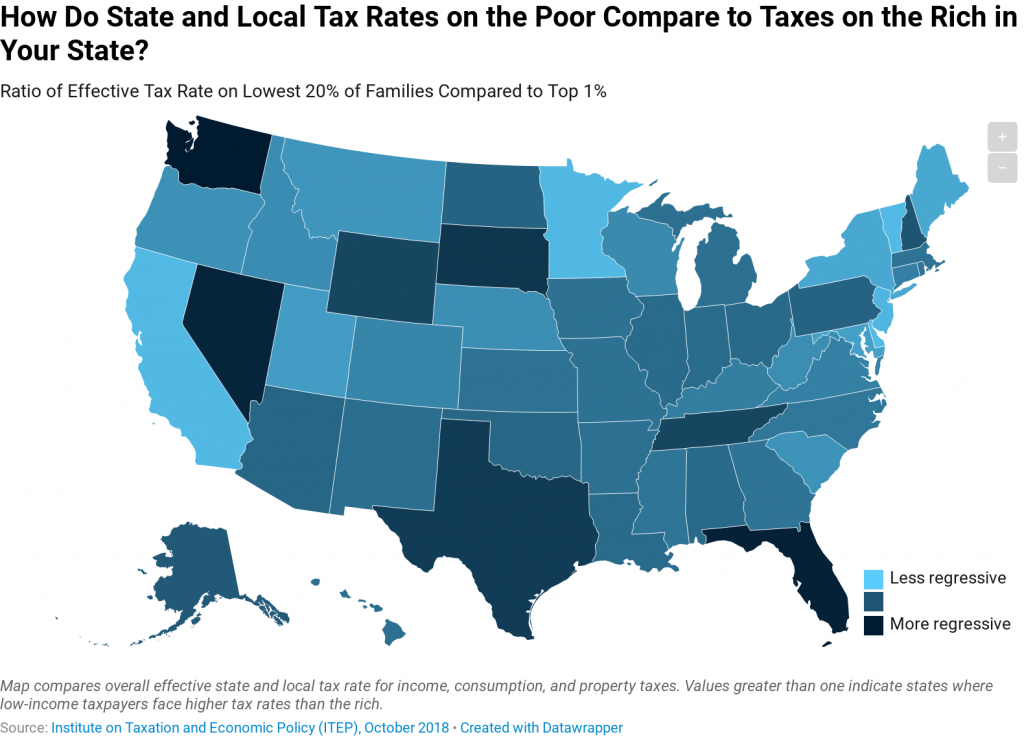

Maine Reaches Tax Fairness Milestone Itep

How Is Tax Liability Calculated Common Tax Questions Answered

Tax Maps And Valuation Listings Maine Revenue Services

Maine Income Tax Calculator Smartasset

Montgomery County Md Property Tax Calculator Smartasset

Property Taxes By State 2017 Eye On Housing

Maine Estate Tax Everything You Need To Know Smartasset

How Do Tax Rates On The Poor Compare To Taxes On The Rich In Your State Itep