georgia film tax credit history

For example you could purchase 20000 of 2017 Georgia Entertainment Credits for 17400 resulting in an immediate savings of. In fact according to the Georgia Department of Economic Development there was a new record set last year with 399 productions filmed representing a 29B infusion to the state.

Georgia Film Tax Credits Paramount Tax And Accounting Llc

On average 1 of Georgia Film Tax credit can be purchased for 087 to 090.

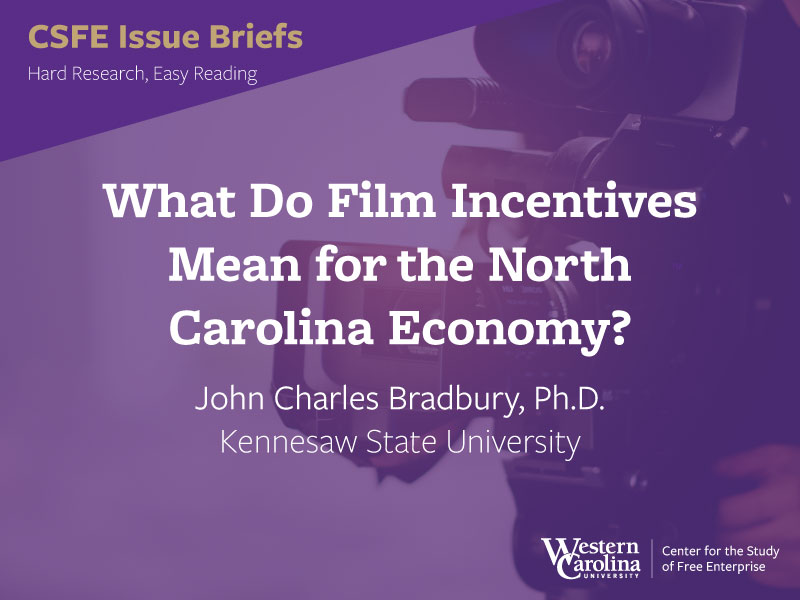

. Production companies are required to withhold 6 Georgia income tax on all payments to loan-out. The film industry in Georgia is the largest among the states of the United States for production of feature films by number of films produced as of 2016. To earn the 20 film tax credit the Georgia Department of Economic Development must certify the project more on this later.

An audit is required prior to utilization or transfer of any earned Georgia film tax credit that exceeds 25 million in 2021 125 million in 2022 and for any credit amount thereafter. The threshold decreases to 125 million for productions certified in 2022 and in. GEORGIA FILM TAX CREDIT For a project to be eligible for the 20 base transferable tax credit the Georgia Department of Economic Development must certify the project.

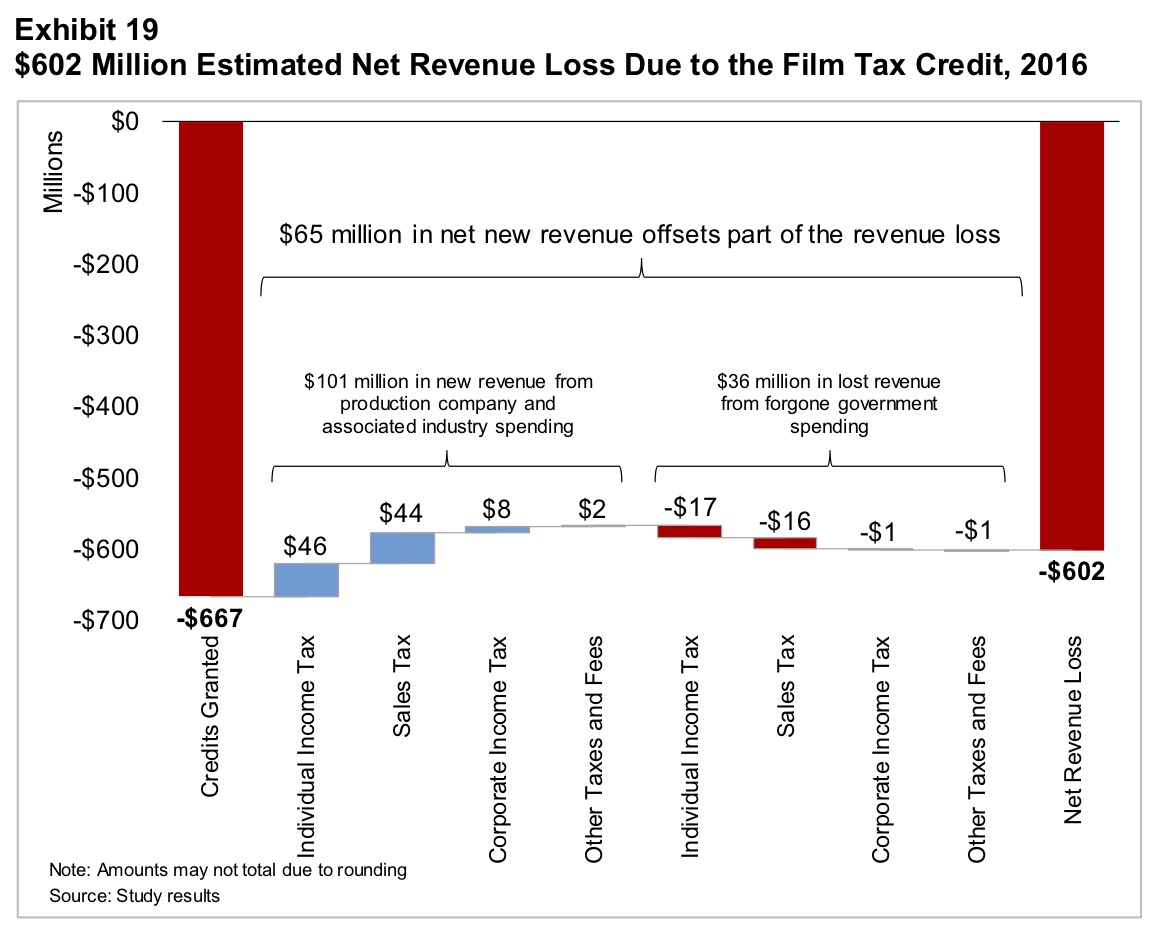

The film tax credit is Georgias largest tax credit. Georgia Impact of the Georgia Film Tax Credit 2022 Economic Community Development Tourism Finance Taxation GA Department of Audits and Accounts. Qualified projects distribution must extend outside.

Productions that qualify receive a 20 tax credit. However companies received film tax credits they did not qualify auditors claim. An additional 10 credit is given for placing a Georgia logo in your film title or credits.

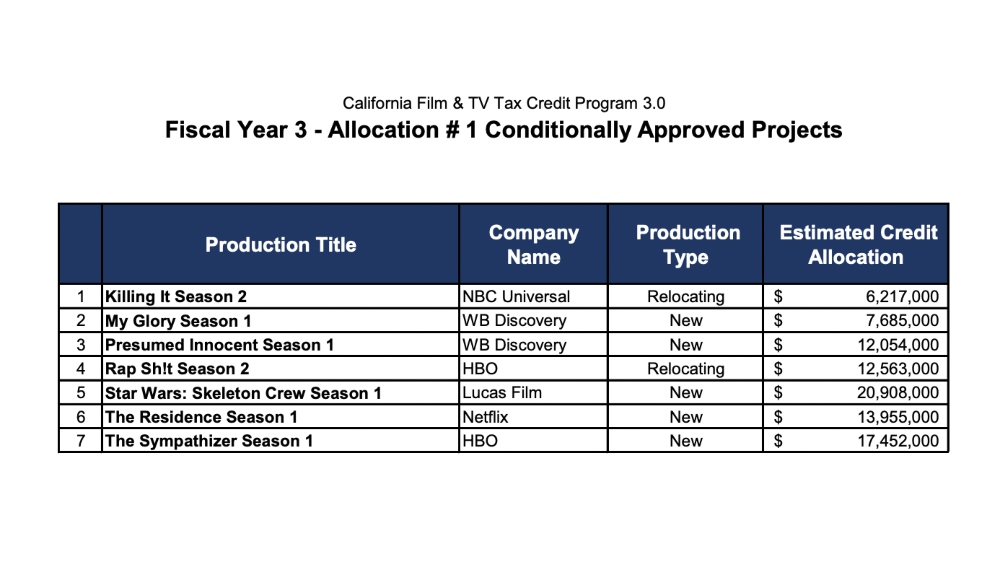

Atlanta is the center of the film industry. More than 3 billion in credits were generated from 2013-2017 with the amount increasing each year. This is an easy way to reduce your Georgia tax liability.

Some Georgia film tax incentives include. The state agencies in charge of Georgias film tax credit have strengthened oversight of the program by fully or partially addressing all shortcomings. Georgia is providing up to 30 in tax credits for companies producing feature films television series music videos and commercials as well as interactive games and animation.

The tax credit had grown from 141 million in 2010 to an estimated 870 million in 2019. Audits are mandatory only for credits of more than 25 million that are first certified in 2021. In 2016 more than 667 million in film.

Georgia Entertainment Tax Credit Services Company

![]()

Georgia Film Tax Credits Cabretta Capital

Georgia Tax Refunds Will Start Heading Your Way This Week

Movie Tv Tax Credit Cap Removed From Georgia Legislation

Georgia Pulls Bill Proposing To Cap And Prohibit Sale Of Film Tax Credits The Hollywood Reporter

California Film Commission Accepts New Series Into Tax Credit Program Including Star Wars Skeleton Crew Below The Line Below The Line

Another Record Breaking Year For Georgia Film And Tv 455 Productions 2 7 Billion In Direct Spending

Georgia Lawmakers Expected To Consider Boosting Music Industry Tax Credits Georgia Public Broadcasting

Essential Guide Georgia Film Tax Credits Wrapbook

What Do Film Incentives Mean For The North Carolina Economy Center For The Study Of Free Enterprise

California Film Commission Accepts New Series Into Tax Credit Program Including Star Wars Skeleton Crew Below The Line Below The Line

Entertainment Accounting And Financial Services Mauldin Jenkins

10 Best States For Film Production Tax Breaks

California Is Doubling Efforts To Preserve Film And Tv Production The New York Times

Analysis Georgia S Film And Tv Incentives Could Become Part Of A 2020 Budget Battle

The Secret Sauce Of Georgia S Extraordinary Film Industry Georgians Saportareport

/cdn.vox-cdn.com/uploads/chorus_asset/file/9090113/GeorgiaFilming_BUG_Getty_Ringer.jpg)

How Atlanta Is Taking Over The Entertainment Industry The Ringer

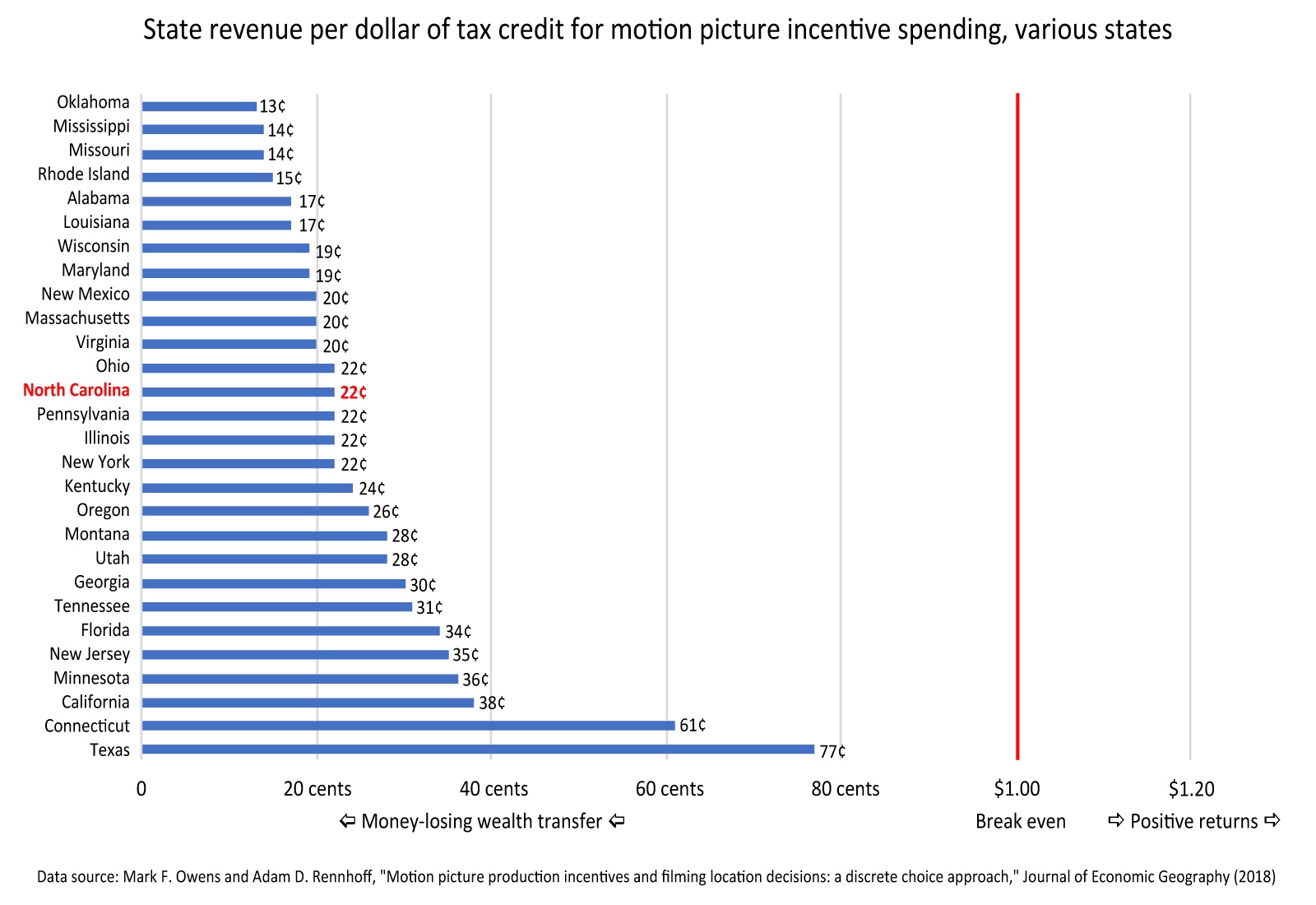

Audit Georgia S Return On Investment For Its Film Tax Credit Was 10 Cents On The Dollar

Audit Georgia S Return On Investment For Its Film Tax Credit Was 10 Cents On The Dollar